How to Save

In 2020 we were introduced to social bubbles and we ended the year with Christmas bubbles (depending on your geographical region). The word bubble reminds me of comfort and protection against external risks. In 2021 let’s introduce a financial bubble where you are assured you have done everything you can to protect yourself from financial despair. We are currently living through an unprecedented times. There are several economists predicting our future but, let’s be honest, no one really knows how we are going to get out of this.

It is our responsibility to do what we can to protect our assets. I completely appreciate there are people that do not have control over their situation due to being furloughed and redundancies, and my heart goes out to them. The other half are the fortunate ones that saved a lot in 2020 (let’s ignore the daily Amazon purchases shall we).

Did you know that 41% of British citizens do actually not have enough saved to cover a month’s bills? Ten percent do not have any savings at all! I am hoping by reading this blog you are the other 90%. I have a few tips on how to build your savings to achieve your goals. I used to find it really difficult to save because there is so much demand to spend money. There are new gadgets coming out every 2 minutes and life is just expensive.

I bought my own property in London at the age of 27 and I used these simple steps to save for my deposit. I managed to save £22k in three years and I was still living my best life. I am sharing these simple tips to the world so you can also achieve your ambitious saving goals.

The 4S Saving framework

Who doesn’t love a simple framework? I created an easy way to achieve your saving goals. Review your income and deduct all your fixed expenses, then what you have left is your disposable income leaving you with what you can actually afford to save

1. Set a goal

2. Saving pots

3. Standing orders

4. Stick to the plan

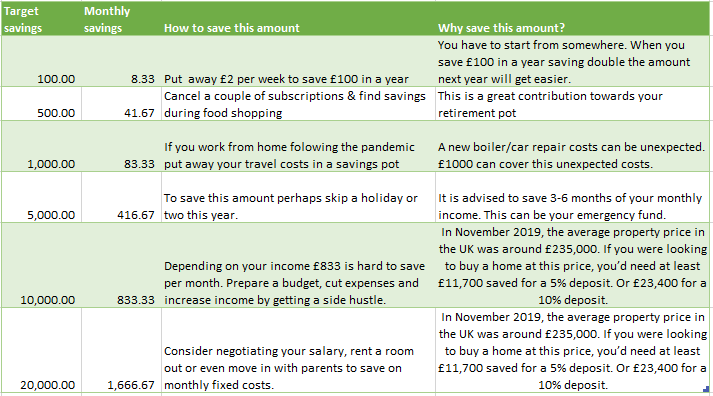

1. Set a goal – What are you saving for & why? It helps motivate you and get some discipline. Break it down into milestones. It is advised that you have 15% of your monthly income throughout your life for retirement. You should also have 3-6 months worth of emergency funds in case you are ill or lose your job – or if you are saving for a nice holiday/car/house. That already means you have three different saving goals which leads you to having separate pots.

Below is a breakdown of various savings targets in a year

2. Separate pots for separate goals – If you have multiple projects you are saving for then have multiple saving accounts. It is easier to track your financial goals if they are in different accounts. I would advise you research interest rates in order for you to get the best return. Contact a financial advisor for the best deals. Here are five popular types of savings accounts.

Easy access savings accounts -They have a lower interest rate however they are easily accessed. There is no limit for how much you save. I would recommend using this type of account for an emergency pot.

Notice savings accounts – Require you to give advance notice that you intend to make a withdrawal. Notice accounts usually earn higher interest rates than easy access accounts. I would recommend using this account for a bigger goal such as a deposit for a property.

Regular saver accounts – Requirements vary from bank to bank, but you’ll usually need to pay in at least £25 and not more than £500 per month. You’ll also have to commit to making these regular payments for an agreed period of time, typically 12 months. I would recommend using this account for building up your savings and to get a good return from it.

Individual savings accounts (ISAs) – interest rates are usually higher than you’d find on other types of savings accounts because they are tax free, however, there’s a limit to how much you can deposit into an ISA each tax year. This is known as your ISA allowance. In the current tax year (2020/2021) this amount is set at £20,000. This type of account is best for long term saving goals.

Fixed-rate bonds are accounts that allow you to deposit a single lump sum for a set period of time. In general, the longer you tie your money up for, the higher the interest rate. This type of account is best for long term saving goals.

3. Set up a standing order – It is 2021! You can easily set up a standing order for your savings with most banks. When you set a standing order you can specify the amount, duration and date as to when you would like the payment to be taken out. This means you don’t have to remember to make the payment each month, making the whole process easier.

4. The last and most important point is for you to stick to the plan! You will be super proud of yourself when you achieve your goals. Remind yourself of your Why to motivate yourself until you have reached your target.